o FEBRUARY 2014: THE MAKING OF MEGACOMCAST

Comcast agrees to buy the second-biggest cable operator, Time Warner Cable for $45.2 billion. Charter had offered $38 billion and was rejected. This sets off a long regulatory review and protests from many corners: a slew of consumer groups, competitors like Dish and Netflix, unions for entertainment-industry writers and a television network, WeatherNation. Sen. Al Franken (D-Minn.), of “Saturday Night Live” fame, was one of it is toughest critics, saying the deal would lead to higher prices, fewer choices for consumers, and threaten innovation and free expression.

o MARCH 2013: MALONE REEMERGES

A company backed by Malone says it will buy a 27 percent stake in Charter Communications for $2.6 billion, setting the stage for future deal-making that will reshape the industry. At the time, Charter had about 5 million customers.

Malone, now 74, made his fortune with Tele-Communications Inc. He was president and CEO from 1973 to 1996 and sold it for $48 billion in 1999. He controls or has interests in several cable and media companies in the U.S. and abroad.

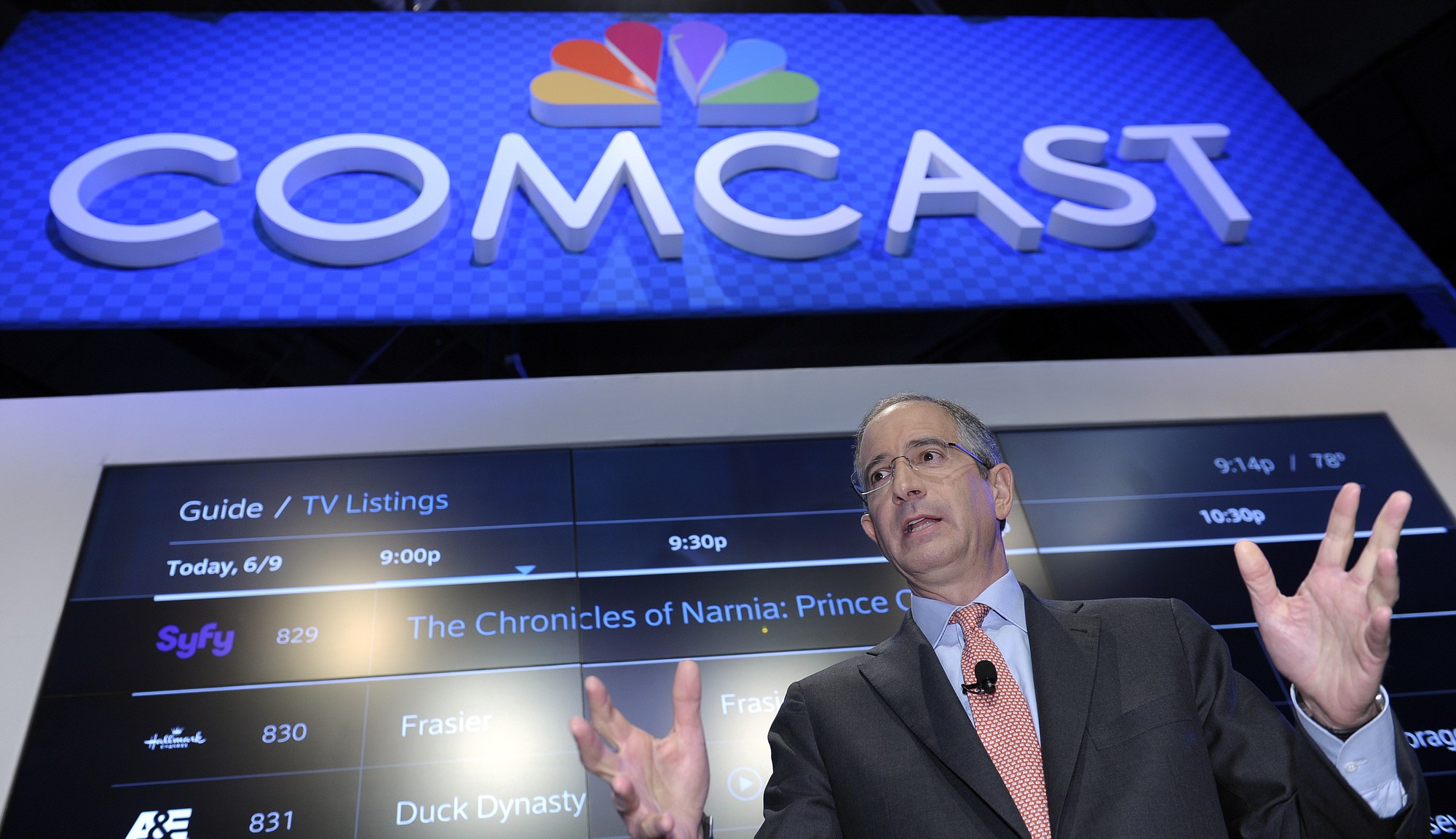

o JANUARY 2011: COMCAST BECOMES ENTERTAINMENT GIANT

Comcast clinches a 51 percent stake in entertainment behemoth NBCUniversal after a regulatory review that lasted about a year. The deal prompted an outcry from consumer and media advocacy groups and was even spoofed on the NBC show “30 Rock.” Comcast paid General Electric $6.2 billion in cash and contributed its existing channels like E! and The Golf Channel, worth $7.25 billion, to NBCUniversal. Comcast bought the rest of NBCUniversal from General Electric, for $16.7 billion, in March 2013.