Vancouver-based industrial laser manufacturer nLIGHT posted its fourth-quarter and full-year 2019 earnings report on Wednesday, detailing a challenging year that saw a drop in revenue due in part to sluggish demand in the microfabrication market, as well as impacts from the trade war with China.

The company said it expected to take an approximately $8 million revenue hit in the first quarter of 2020 due to the outbreak of the novel strain of coronavirus known as COVID-19, which originated in China’s Hubei province in December and spread quickly, triggering large-scale quarantine efforts and travel restrictions.

“Over the past several weeks it has become clear that the COVID-19 virus is impacting the demand environment and our internal operations,” CEO Scott Keeney said in a Wednesday conference call with investors and analysts. nLIGHT operates a manufacturing facility in Shanghai.

Several of the analysts on the call pressed Keeney and chief financial officer Ran Bareket for more information about the expected impacts of the coronavirus and the forecasted $8 million hit.

Bareket said the biggest impact would come on the supply side due to supply chain disruptions and increased manufacturing costs. Keeney added that travel restrictions have slowed the Shanghai factory’s return to full staff levels after the Lunar New Year holiday.

“As we get into March, I think we’ll be substantially back to normal by then,” he said.

nLIGHT’s revenue for the fourth quarter was $42.9 million, a 7.1 percent year-over-year drop. Gross margin was 23.3 percent, compared with 35.8 percent in the fourth quarter of 2018. Revenue for 2019 overall was reported at $176.6 million, a 7.7 percent decrease from the $191.4 million from 2018. Gross margin for the year was 29.6 percent, compared with 35 percent for 2018.

nLIGHT typically categorizes its sales into three markets: industrial, microfabrication and aerospace and defense. The microfabrication market took the biggest hit in 2019, according to Keeney and Bareket.

In the fourth quarter, microfabrication sales represented about 26 percent of the company’s revenue and were down 41 percent year-over-year, Bareket said.

Keeney attributed the decline in part to a lackluster consumer electronics market, which he said resulted in fewer manufacturers looking to refresh their tools. He said that market segment could pick up as the buildout of 5G cellular networks gains steam.

The industrial market fared better, Bareket said, rising 6.7 percent year-over-year and representing 43 percent of nLIGHT’s total revenue. Aerospace and defense was responsible for 30 percent of revenue and grew 35 percent year-over-year, but it wasn’t enough to make up for the microfabrication losses.

Keeney described the aerospace and defense market as a key growth driver, and announced that the company secured a $38 million order in the fourth quarter for the continuation of a long-standing program with a defense contractor. He didn’t name the contractor.

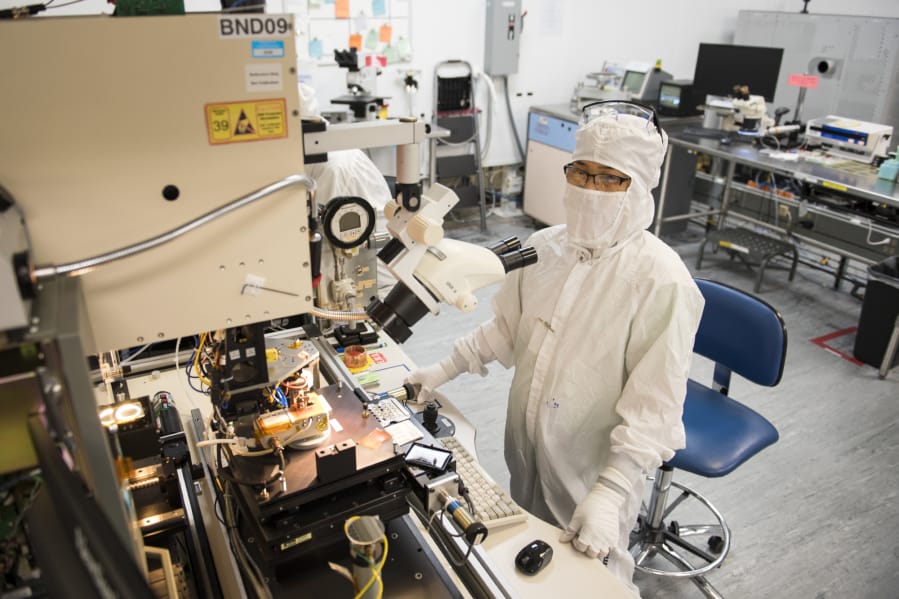

Keeney discussed the company’s advancement in both traditional semiconductor lasers and in newer fiber lasers in 2019, including the launch of a 15-kilowatt fiber laser, the company’s highest-power product. The laser market continues to shift toward higher-power models, he said, particularly in China.

nLIGHT has relied on high-power lasers to drive growth in the Chinese market, where the company faces challenges from aggressive competition and tariffs, but Keeney also pointed to further growth potential in the industrial market outside of China, which he said would be driven by nLIGHT’s Corona brand of programmable fiber lasers.

nLIGHT acquired Colarodo-based laser manufacturer Nutronics in November, and on Wednesday’s call, Keeney said that the integration of the two companies was proceeding smoothly. Bareket said that moving forward, the company would present its financial reports in two segments: one for its laser product lineup and another for what he referred to as “advanced development,” which would include government contracts and most of the revenue from Nutronics.