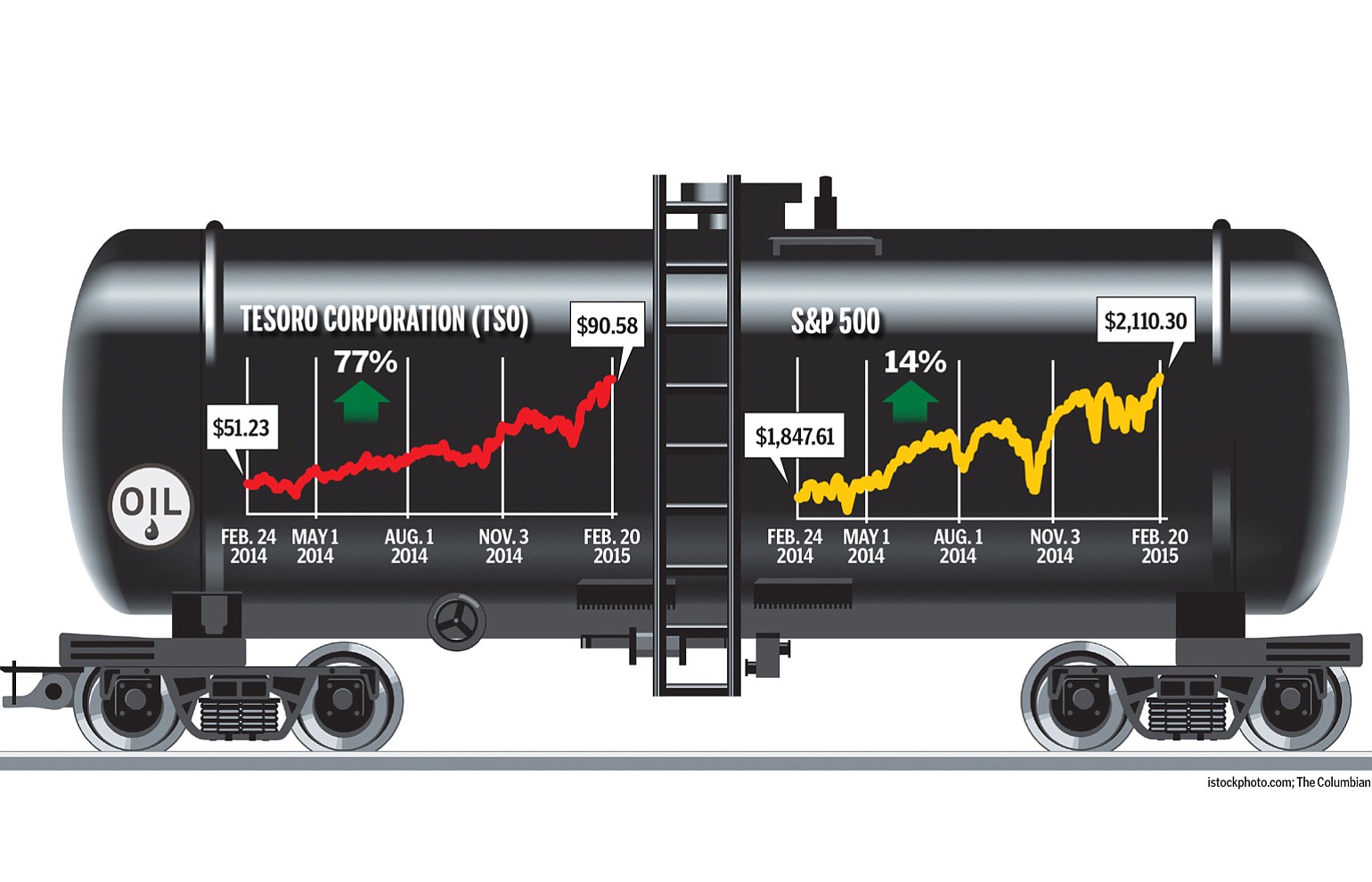

The timeline for the opening of a new rail-to-marine oil-transfer terminal in Vancouver keeps getting pushed back, but investors in Tesoro Corp., the publicly traded part of a joint venture proposing the facility, don’t seem overly concerned. In fact, some believe if the project were to fall through completely, Tesoro’s stock price would hardly be affected.

That’s the picture that emerges from a review of the company’s regulatory filings, interviews with investment managers and an inspection of analyst reports about the company.

One manager of a fund that invests in refinery companies said only about one-third of the investment banks following Tesoro assumed in their valuations that the Vancouver oil terminal would win government approval. The rest of the investment banks think Tesoro’s stock price would benefit from the oil terminal’s construction but is not tied to that approval, the manager said. The manager spoke on condition that he not be identified because the firm does not typically speak to the press.

Tesoro, a petroleum refiner, and privately-held Savage Companies, a transportation company, have formed a partnership called Vancouver Energy that proposes to build the $190 million oil transfer terminal at the Port of Vancouver. The terminal would be capable of moving an average of 360,000 barrels of crude a day from trains coming from the Bakken formation — which lies underneath parts of North Dakota and Montana, and the Canadian provinces of Alberta, Saskatchewan and Manitoba — onto tanker ships that would then transport that oil to Tesoro’s West Coast refineries, chiefly those in California.